|

|

|

|

|

|

About the Company: A rapidly expanding Middle Market Leasing / Finance Company located in CT. Equilease Financial Services, Inc |

Tuesday, February 8, 2005

Headlines---

Classified ads---Collector/Controller

Economic Events This Week

Cartoon---

Why 43 Leasing Companies?

Another Hammered Down

Trustee looks for help with Cyberco

Classified Ads--Help Wanted

What-Me, worry???

Leasing Association Meetings Open to Non-Members

Financial Federal 19% Q Increase/Declares Dividend

O'Charley's Conducting Review of Lease Accounting

News Briefs---

"Gimme that Wine"

This Day in American History

Baseball Poem

######## surrounding the article denotes it is a “press release”

|

|

-----------------------------------------------------------------

Classified ads---Collector/Controller

Collector

Collector: Boston, MA. Challenging position where my skills, professional experience, organization, leadership, strategic thinking, creativity, energy, passion, competitive nature will enable me to define opportunities and personal development. |

Collector: Jacksonville, East Brunswick, FL. |

Collector: West Hartford, CT. Credit/Collections /Rental Management in leasing & construction fields. Looking for stable company that will appreciate my 20+ years of experience. |

|

Controller

Controller: Seattle, WA |

Controller: Southeastern, MI. |

Full listing of all ads here:

http://64.125.68.90/LeasingNews/JobPostings.htm

----------------------------------------------------------------

Economic Events This Week

March 9

Wednesday

Beige Book

March 10

Thursday

Federal Budget: February

Weekly Jobless Claims

March 11

Friday

Balance of Trade: January

----------------------------------------------------------------

----------------------------------------------------------------

Why 43 Leasing Companies?

---An “interview” with the “top” FTC Leasing Company Prosecutor

by Christopher Menkin

These questions came from a person I call the top Federal Trade Commission leasing equipment prosecutor, who called me to talk about “forced insurance.” In less than the first 30 seconds, I picked up he not only knew quite a bit about equipment leasing, just by the words he used, the vernacular, but by the questions he started with.

It was not until the end of the conversation did I get to ask him for his background. I learned he had a history of winning cases as the lead attorney against those who violate the law, including large equipment leasing companies.

“How about a leasing company then that gets ten NorVergence leases to fund in the same day, all the contracts have the same equipment, one Matrix box, nothing else, and the contracts range from $20,000, $50,000,$150,000...Wouldn't someone question that?”

My mind went to Doug Hatch at Bank of the West, Allen Moehle at Pacific Capital Bank Leasing, Alan Kissinger at Financial Pacific, and even Marlin Leasing wants social security numbers on principals from a vendor less than one year in business for a $5,000 lease. I also thought of the heads of funding departments that I had direct experience with, and their staff, no way would this happen at any of their places. In my experience, they pick apart some standard issues, questioning everything, let alone something as obvious as this.

I did not answer the question, but thought there were 43 leasing companies who funded NorVergence leases. In the course of funding the leases, no one asked why?

“Also don't you think it is strange that a county assessor's office gets leasing company filings for equipment, one matrix box, and the dollar amounts are quite different on each one? Wouldn't that raise a red flag somewhere with the person making the filing for the leasing company?”

“What about leases written at a 25% yield to the lessor for excellent credits for leases from $50,000 to $200,000 lease, wouldn't that ring someone's chimes?

I have talked to many of the local districts attorney prosecuting staff and various state attorneys general top fraud and telecom chiefs and their staffs on this subject, who knew the law, but where I had to explain more basic. In each conversation, they were becoming more familiar with the “procedures” of equipment leasing, but talking with this top FTC prosecutor was like talking with a Certified Leasing Professional.

He knew about computing leases on an HP calculator, the going “buy rates” at various leasing companies and banks, their restrictions on commissions, and the procedures used when funding a lease.

Specifically I did not ask him if this was “off the record,” and to be fair about it, I am keeping it that way. If I had asked his permission, he would most likely have said no, and then I would not be able to write about our conversation. He did not make any comment or opinion about the matter, so there really is nothing to divulge, except for the questions he asked, which I thought were pretty revealing of what he knows and the direction he may be headed when he goes to court

(the FTC has announced they are investigating NorVergence, its officers, and their roles with various leasing companies.)

The telephone call was arranged via e-mail about the comments I had made on a Yahoo listserve ( he evidently reads the message board or receives the e-mails.) In addition to writing about the calamity, the fact that I was not only in the leasing business, but was a licensed insurance broker at one time, he wanted to know about “forced insurance,” as he called it, the practice in the industry in determining and enforcing it; basically the procedure leasing companies used when the lessee did not provide insurance, how it works and what is covered ( meaning replacement of the Matrix box.)

He went through several scenarios of a fire or a burglary of the business and the procedure of how the equipment value is obtained for replacement or the insurance claim is process from the leasing company's viewpoint.

Surprisingly I learned most of the ERA insurance was not on the “cost to lessor” or “invoice cost,” but on the “stream of payments.” He wanted to know how common that was, and the procedure the leasing companies used, along with providing “more” names of insurance companies who provide this service to leasing companies.

He wanted to know the procedure on how the “equipment” was listed on the certificate, and would an insurance agent question the value, or if the agent had several requests for insurance certificates for the same equipment at different dollar amounts, how would that work? And how would that work from the leasing company's requests or “forced insurance,” especially if it were on the “stream of payments” and not the “invoice” cost.

While I thought most insurance agents have their staff type up the certificates, rarely do they look at them or even question the value of the equipment. Perhaps if it were a vehicle and they saw it was a 1989 Pontiac for $50,000, it would certainly raise questions, but a piece of equipment that they know nothing about and are relying on their customer and also the leasing company who requested it, rather doubt it would be questioned. Even if the agent had several clients where the amounts differed but the equipment was the same description: one matrix box.

The time to correct any problem with the dollar amount was upon signing the lease contract and the insurance verification form, and more than likely the verification by the insurance agent. A replacement would be normally on the “cost to lessor” or “invoice cost” and not the “stream of payments.”

He wanted to know in the “forced insurance” program if the company was receiving many of these requests on the same type of equipment, would that be normal. Also if the equipment was always the same, but the dollar amounts varied from $10,000 to $75,000, would the insurance company question this?

I did not answer the question, but thought there were 43 leasing companies who funded NorVergence leases. Why? Did they ask similar questions?

We talked about many such “forced insurance” situations and procedures. I told him if he wanted to speak to some leasing company officers about their company's procedures, I would try to open the door for him on an informal basis rather than a deposition.

He then asked about the funding of ten leases a day, and in some instances, there were more than that at one leasing company. In all the lease contracts, the equipment was the same, one matrix box, not other information or models, and in some cases, two matrix boxes, all at varying prices from $10,000 to one $260,000.

In most states, service, software, and other such costs are not subject to personal property tax. The lessor was going by the "invoice cost" or what is known as "cost to lessor." Most contend they were not aware of the soft costs in the lease. Most likely all the lease figures submitted to the county are incorrect and the lessee should receive a refund in almost all the instances. The lessee is entitled to a copy of what the county charged the lessor to compare what the lessor charged the lessee---another issue that complicates all the matters.

“What about the ‘implied interest rate?”

In one of the depositions I read on an vice-president of a “bundler” of leases, they had a 12% buy-rate and NorVergence could not discount a contract over 120% of the cost, meaning their “commission” or “administrative fee” could not exceed 20%--no restriction of dollar amount either meaning, a $10,000 or $75,000 lease, under this “application only” program. From some of the contracts I saw, the commissions were well over 15% all the time, on some top credits.

I did not answer the question, but thought there were 43 leasing companies who funded NorVergence leases and wondered if they all were giving such high commissions or “administrative fees.” I have seen several where the discount was capped at 120% of the “invoice cost.” I was told by an ex-employee IFC Credit had 25% yields on their leases.

Another subject centered around late charges and other fees, especially in states where commercial leases may also be considered “consumer” leases, such as in Massachusetts, where “enterprises and consumers” fall into the same category, plus laws regarding telecommunication which may have other such provisions and equal the production afforded similar to the federal consumer credit act.

In the Leasecomm matter, the settlement cancelled $24 million in what were called “deceptively obtained judgments against consumers.”

From the FTC press release:

"Leasecomm's customers got a one-two punch," said Howard Beales, Director of the FTC's Bureau of Consumer Protection. "Leasecomm used sellers of highly suspect business opportunities to sell its financing, and then claimed it had no responsibility for their deception. Companies that try to hide behind the fine print in contracts and lie to consumers about what they're were signing, whether directly or through agents, simply do not pass muster."

Another question I could not answer:

“Could these lessors also claim depreciation or other benefits, as there was no residual at the end of any of the ERA leases? Is that also why the insurance was based on the stream of lease payments?”

Other questions I could explain, but had no direct knowledge or specific information.

“Let's get back to the leasing companies as they have credit and other requirements. How would they accept the ERA contracts, let alone NorVergence as a ‘discounter' of leases?”

This was an easy one to answer as I have personal experience in this. When I first started out discounting and then establishing recourse lines of credit, I would take submit the contract I wanted to use. No one ever asked who was the author ( Barry Dubin, Cooper-White-Cooper) and the Crocker bank attorneys looked it over, and then when I went to Wells, the Wells Fargo attorneys, looked it over. When I went to Union bank, I told them Wells and Crocker approved it. They never checked this statement out, as I would have known, and when I went to the next source, and told them Union Bank, Wells Fargo, and Crocker banker approved it, they never questioned. In opening lines at community banks, they stopped asking as they would check out the experience at the previous banks, look at the financial statements, personal guarantee, and that was that. So once one or two approved it, everyone trusted what I told them. The same most likely happened with the NorVergence “Equipment Rental Agreement,” although it does look like a “ hodge-podge” and even I could see sections that would be difficult to hold up in most state courts as to how they were worded ( now not an opinion, but reality as ruled by various federal and state judges.)

The same procedure is how NorVergence also got into some of the larger leasing companies. In stories hat Leasing News wrote about RW Professional, how hey made a settlement with Old Kent Bank

(employee covenants released when the bank went out of business)

including an agreement not to mention this, or with CIT, where they had a $10 million disagreement, whittled down to $500,000, covered by loss reserves, according to a very reliable source, when they went to the next bank, they used these two as references. Imagine they come to your busy place, brought by the director and then president of a leasing association, doing business with these community and regional banks, and a list of satisfied funding sources. “If they were accepted there, we'll give them a try,” would have been the answer.

Leasing News had been writing about NorVergence complaints for approximately two years, settling the complaints, and also questioning the involvement of the president of a leasing association, who we spoke to on numerous occasions.

During this time, we were threatened with legal action, but did answer telephone calls, including one with top officer of a major bank, who was approached o fund these leases, but heard about some of our articles. We told him not to do it, and why. He then named several financial firms and banks that were funding these transactions, and because of that was quite tempted as the credits looked very good of samples he had been given. He was one of many who called us after the bankruptcy to thank us for the warning. Despite the references they had given him, we had cautioned him enough that he did not want to put his bank at risk.

Interestingly it appears from what I have talked to NorVergence lessees, there were no professional leasing consultants or brokers involved directly, including leasing companies. All of this was handled by the NorVergence sales representative. They were not given any alternatives and told to sign the contract if they wanted “service.”

It also does not appear that systems were “purchased” outright, although there may be cases of that. In the bankruptcy hearing in New Jersey, NorVergence estimated they had 11,000 leases

( “Equipment Rental Agreements.)

The “top” leasing FTC prosecutor never asked why so many leasing companies were required in the fundings of these “Equipment Rental Agreements.” My count from the various list serves was 43, although 25 are being “prosecuted” today. In several instances, from depositions, several leasing companies cut off NorVergence when they started received complaints from their lessees, or learned more about what they were leasing, perhaps.

Perhaps they eventually began to ask why the same equipment with a great disparity of “cost to lessor ” in fundings, insurance, personal property tax ,and NorVergence was forced to find other sources.

----------------------------------------------------------------

Another Hammered Down

Leasing News printed the NorVergence "Equipment Rental Agreement"

and commented there were several provisions that even we could see that the courts would rule against, naming several, including the choice of venue ( most courts have ruled against it, citing the matter to be in the lessee's choice of venue, including the most recent one by the Illinois court.)

Here, the acceleration clause in the NorVergence rental contract form is ruled a penalty under Texas law because it may be invoked upon even a minor default.

Attorney Paul H. Cross of Irving, Texas represent the lessee in this case against IFC Credit Corporation. Here is a copy of the summary judgment:

http://leasingnews.org/PDF/Salazar,JohnR.pdf

----------------------------------------------------------------

Trustee looks for help with Cyberco

By Ed White

The Grand Rapids Press

Mlive.com

GRAND RAPIDS -- The trustee overseeing the bankruptcy of Cyberco Holdings wants help from former executives as he tries to tally numbers at the collapsed high-tech company.

U.S. Bankruptcy Judge Jeffrey Hughes soon will order James Horton to assist the trustee's legal team, but not the widow of deceased Cyberco chief Barton Watson -- at least not yet.

Krista Kotlarz-Watson has "limited knowledge of all the workings" at Cyberco, also known as the CyberNET Group, her attorney told the judge Thursday.

"She's not quite sure what her role was," Perry Pastula said. "She relied on her husband ... and did what he asked her to do."

The company imploded in November when authorities discovered Cyberco was acquiring millions of dollars in loans for equipment that didn't exist. The money instead was used to enrich Watson, his wife and others, the FBI alleges.

No charges have been filed. While federal authorities investigate, creditors are in Bankruptcy Court seeking any assets.

The trustee's attorney, Steve Rayman, needs help compiling lists of assets and liabilities. He also would like to learn more about the company's dealings with lenders, although cooperation might be limited.

Statements by Horton, Kotlarz-Watson or financial chief David Roepke could be used against them in the criminal probe.

"If they're going to take the Fifth, they're going to take the Fifth," Hughes said, referring to the Fifth Amendment right against self-incrimination.

Outside court, Rayman acknowledged that "criminal law trumps what we do."

He would like to talk to former company officials off the record, but that would require approval from the U.S. Attorney's Office.

Meanwhile, there is a March 15 hearing on the trustee's request to sell furniture, equipment and other assets at CyberNET offices at 25 S. Division Ave. The company's wine collection also will be sold.

The documents show the government has now officially seized millions in cash from the company's four bank accounts, which each have roughly three-quarters of a million dollars, a baby drop in the bucket for what is alleged.

At least 400 creditors (many are leasing companies) are looking for $60 million, maybe $65 million. Authorities believe they might be able to scrape up $5 million, maybe $10 million, in assets, leaving about $50 million still missing.

New names in the affidavit pop up as well, like Geraldine Watson, the mother of Barton Watson who killed himself in November after a raid of the business on Division Avenue.

It is alleged that Barton and wife Krista were masters at duping creditors. At one point, they secured a $17 million line of credit from Huntington Bank.

The St. Louis Business Journal reports:

Three regional banks -- Heartland Bank, Pioneer Bank and Trust in St. Louis, and Bank Midwest of Kansas City -- are owed more than $7.6 million, and possibly as much as $11 million, by a bankrupt Grand Rapids, Mich., technology company.

Pioneer Bank Chief Executive Gaines Dittrich said when the bank saw the loan could be a problem, it sold the note to its parent company, Forbes First Financial Corp. in St. Louis, to remove it from Pioneer's books. Tom Brouster, the primary owner of Forbes First Financial, could not be reached for comment.

"This will have no impact on the bank," Dittrich said, adding that Pioneer's earnings for 2004 were up 50 percent to $3.75 million from 2003's earnings of $2.5 million.

CyberCo.'s alleged fraud began to unravel in mid-November, a little more than a week after some of the banks had loaned millions of dollars to the company, according to court documents outlining CyberNET's dealings.

Charter One Vendor Finance of Illinois sued CyberCo in Michigan Nov. 19 claiming it loaned CyberNET $3 million to buy 66 computer servers. Charter One said it could find only 25 servers at the company's Grand Rapids headquarters, and CyberNET's executives could not provide an explanation for the missing equipment. Within days, other lenders also inspected CyberNET's offices and could find none of the equipment covered in their loan agreements.

On Nov. 25, after a standoff with local police, CyberCo's Watson was found dead in his home from an apparent self-inflicted gunshot wound.

Creditors forced CyberCo Holdings into bankruptcy in December. The company had assets of $4 million and liabilities of $65 million. "We haven't been able to see all the records, because they were seized by the FBI," said Steve Rayman, an attorney in Kalamazoo, Mich., representing CyberCo's bankruptcy trustee.

CyberCo made its connection with the St. Louis banks through a loan broker who had brought prospective loan clients to those banks before, said a banker familiar with CyberCo's loans in St. Louis. Riverbend Capital Group in St. Louis County is identified in the bankruptcy documents as a loan broker that had secured loans for CyberCo from Pioneer Bank. Pioneer's attorneys want a deposition, or formal testimony, from Riverbend's president, Tom Sears, about the CyberCo case, according to bankruptcy court documents. Sears said he has not given a deposition in the case and is not at liberty to discuss the matter.

Heartland Bank is represented in the CyberCo case by Greg Willard, who leads the bankruptcy practice at the Bryan Cave law firm. The other area banks hired law firms based in Michigan.

Loan brokers shop prospective deals to banks for customers that usually have been turned down in their home market, according to banking industry observers. Brokered loans can carry higher interest rates, but also present a greater risk. Executives at a bank making loans on computer equipment two states away should raise questions about why the loan could not get funded in the company's own backyard, those industry observers said.

-----------------------------------------------------------------

Classified Ads---Help Wanted

Collection Attorney

|

Spiwak & Iezza, LLP, Westlake Village, Ca. is an extremely aggressive collection law firm that believes in taking action against debtors quickly and pushing through to final resolution without delay. |

Middle Market Sales Representative

|

About the Company: A rapidly expanding Middle Market Leasing / Finance Company located in CT. Equilease Financial Services, Inc |

National Account Manager

|

|

Platform Business Manager / Asset Manager

|

Asset Manager: Organized, decisive individual w/ asset mngt./ remarketing exper., covering wide range assets from manufacturing equipment to transportation, energy-related,, technology, retail, etc. Send your resume to: Kathy.odwyer@rbos.com About the Company: RBS Lombard, Inc., based in Chicago, is a member of The Royal Bank of Scotland Group, an AA rated company that is the 6th largest bank in the world by market capitalization as of January 14, 2005. Founded in 2002, RBS Lombard, Inc. has grown to net assets exceeding $2.8 billion and new business volume surpassing $1.1 billion in 2004. |

Sales Professionals

|

|

|

Madison Capital, a Baltimore based equipment and vehicle leasing company for 30 years is a national provider of direct financing services for both vendors and lessees. www.madisoncapital.com |

Small Ticket Sales Representative

|

Advantage Leasing is a 20 yr. old company located in West Chester, PA. We have multiple funding sources as well as internal financing. |

-----------------------------------------------------------------

Wells Fargo's Entire ATM Network Web-Enabled

Bank Technology News

Wells Fargo announced that its entire network of roughly 6,200 ATMs is now Web-enabled. Wells' ATMs feature six language screen options, customizable fast cash amounts, access to 22 financial accounts, and a voice-recognition function for the visually impaired in both English and Spanish.

Wells said its ATMs and 3,000 on-line stations in nearly all of its branches are a vital part of its strategy to integrate all channels. Very few of the bank's customers are single-channel users, according to bank officials. Customers are conducting as many transactions at the ATM as they do with a teller, the officials said. Wells Fargo began deploying its Web-enabled ATM in May 2000. The bank says the Windows-based infrastructure allows it to make updates and add new services to its entire network remotely. The platform also makes it easier for Wells to make future systems improvements such as adding new languages or the ability to accept envelope-free deposits.

----------------------------------------------------------------

What-Me, worry???

“I have met Sal several times when I worked at Citicapital.

“I can absolutely assure you, there is no relationship between the Maglietta and Newman family.”

Best regards,

Brian Carey

Innovative Capital Resources

6835 Almaden Road

San Jose, CA 95120

Office phone number: 408/927-7159

Office fax number: 408/927-7163

Cell: 408/832-8595

E-mail address: bcarey@icresources.biz

web site: www.icresources.biz

--

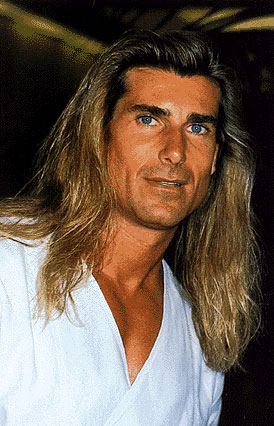

“Kit, you got the wrong photograph of Sal Maglietta as the new president and CEO of U.S. Bancorp Equipment Finance.

“Here is his picture:”

-----------------------------------------------------------------

Leasing Meetings Open to Non-Members

March 17th

United Association of Equipment Leasing Regional Meeting

Thursday, March 17th 2005

4:30 pm – 7:30pm

Renaissance Club Sport, 2805 Jones, Walnut Creek, California

680 & Geary/Treat Blvd, across from Pleasant Hill BART

Please reserve your ticket by Monday, March 7th, via email at:

jhaenselman@befcfinance.com

or call John Haenselman at 650-616-1948

for more information, please go here:

http://leasingnews.org/PDF/NorCalMarch05Flyer.pdf

----------

March 30th Lunch Meeting

Eastern Equipment and Leasing Association

Wednesday, March 30th 2005

"Meet and Greet"

hosted by: Carl Anderson and Carlo LePardo of M&T Bank George Parker of Leasing Technologies International

Longfellows Wayside Inn

Sudbury, Massachusetts

For additional information and registration, please contact the EAEL office at 212-809-1602

----------

April 5th Lunch Meeting

Eastern Equipment and Leasing Association

Tuesday, April 5th 2005

"Meet and Greet"

hosted by Carl Anderson and Mike Neville of M&T Bank

Charley's Crab Cleveland, Ohio

For additional information and registration, please contact the EAEL office at 212-809-1602

|

-----------------------------------------------------------------

### Press Release ######################

Financial Federal Corporation Declares Quarterly Dividend

Announces 19% Net Income Increase 2nd Quarter

NEW YORK------Financial Federal Corporation (NYSE:FIF) announced that its Board of Directors has declared a quarterly dividend of $0.10 per share on its common stock. The dividend is payable on April 29, 2005 to stockholders of record at the close of business on March 28, 2005. The dividend rate is unchanged from the previous quarter.

-- Net Income - $9.2 million (a 19% increase)

-- Record Diluted EPS - $0.53 (a 26% increase)

-- Record Receivables Originations - $274 million (a 53% increase)

-- Record Finance Receivables Outstanding - $1.53 billion

-- Loss Ratio - 0.08% (annualized)

-- Efficiency Ratio - 25%

Financial Federal Corporation (NYSE:FIF) announced its results for the second quarter ended January 31, 2005. Net income for the second quarter of fiscal 2005 was $9.2 million, a 19% increase from the $7.8 million earned in the prior year. Diluted earnings per share increased by 26% to $0.53 from $0.42. Diluted earnings per share increased by a higher percentage than net income due to our repurchase of 1.5 million shares of common stock in April 2004. Finance receivables originated during the quarter were a record $274 million ($43 million higher than the previous record amount set in the fourth quarter of fiscal 2004) compared to $180 million in the prior year. Finance receivables outstanding grew at an annualized rate of 10% to $1.53 billion at January 31, 2005 compared to $1.46 billion at July 31, 2004.

For the first six months of fiscal 2005 and 2004, net income was $17.8 million and $14.9 million, respectively, a 19% increase. Diluted earnings per share increased by 27% to $1.03 from $0.81. Finance receivables originated increased by 41% to $493 million from $349 million.

Paul R. Sinsheimer, CEO, commented: "Positive trends in growth, asset quality and profitability continued in the second quarter. Receivable originations were the highest in the company's history, possibly fostered by our customers' seeking to benefit from an expiring tax incentive. We are encouraged by the strong level of demand for equipment financing and our positive results, but we remain concerned about the near-term effects of rising interest rates and the impact of continued high energy prices."

Steven F. Groth, CFO, remarked: "Our recent credit rating upgrade, driven by our solid operating performance, is enabling us to improve credit spreads, extend debt maturities and maintain substantial liquidity. We produced an 11.5% return on equity for the quarter with our debt-to-equity ratio remaining in the range of 3.5x to 3.6x. Additionally, our Board of Directors has declared our second quarterly dividend of $0.10 per share."

Financial Federal Corporation Steven F. Groth, 212-599-8000

Full press release available at:

http://www.corporate-ir.net/ireye/ir_site.zhtml?ticker=FIF&script=

410&layout=7&item_id=682588

### Press Release ######################

O'Charley's Inc. Conducting Review of Lease Accounting

NASHVILLE, Tenn.----O'Charley's Inc. (NASDAQ/NM:CHUX), a leading casual dining restaurant company, announced that it is reviewing its accounting practices with respect to leasing transactions as a result of a recent clarification of United States generally accepted accounting principles (GAAP) by the Securities and Exchange Commission (SEC).

On February 7, 2005, the Office of the Chief Accountant of the SEC issued a letter to the American Institute of Certified Public Accountants expressing its views regarding certain operating lease accounting issues and their application under GAAP. In the ensuing weeks many restaurant companies and retailers have reviewed their previous interpretations of the lease accounting issues and have subsequently announced that they will be restating their results for prior periods.

In light of this letter, the Company initiated a review of its lease-related accounting methods. Based on this review, as well as discussions with the Company's independent auditors and its Audit Committee, the Company determined that its accounting for leases was not in conformity with GAAP as described in the SEC's letter. Accordingly, on March 3, 2005, management and the Audit Committee determined that the Company would be required to restate its previously issued consolidated financial statements, including those contained in the Company's Annual Report on Form 10-K for the fiscal years ended December 29, 2002, and December 28, 2003, and those in the Company's Quarterly Reports on Form 10-Q for the fiscal quarters ended April 18, 2004, July 11, 2004, and October 3, 2004. Further, management and the Audit Committee have determined that the Company's unaudited consolidated financial results included in the Company's press release issued on February 3, 2005, should likewise no longer be relied upon.

The Company is working diligently to complete its review of these matters and to quantify the impact of the necessary adjustments on each of the affected prior periods. Adjustments will have no affect on historical or future cash flows or the timing of payments under the related leases, nor will they affect the Company's compliance with covenants under its credit facility. The Company does not anticipate that the review will have an impact on its previously issued guidance for the first fiscal quarter of 2005.

Due to the time and effort involved in determining the effect of these adjustments on the Company's historical financial statements, the Company intends to file a Form 12b-25 and to delay the filing of its Annual Report on Form 10-K for the fiscal year ended December 26, 2004, which the Company now expects to file on or before March 28, 2005. The Company's Annual Report on Form 10-K for the fiscal year ended December 26, 2004, will include disclosure of the effects of the adjustments on the financial statements of each of the periods included in the audited financial statements. The Company also intends to file amended quarterly reports for the fiscal quarters ended April 18, 2004, July 11, 2004, and October 3, 2004.

About O'Charley's Inc.

O'Charley's Inc. operates 223 company-owned O'Charley's restaurants in 16 states in the Southeast and Midwest, with two franchised O'Charley's restaurants in Michigan.. The Company also operates Ninety Nine Restaurant & Pub restaurants in 100 locations throughout Connecticut, Maine, Massachusetts, New Hampshire, New York, Rhode Island and Vermont.

O'Charley's Inc., Nashville Lawrence E. Hyatt, 615-782-8818

### Press Release ####################

|

Your One stop solution for training and reference material for the Leasing Professional

|

News Briefs---

Small Business Optimism Steady in February

http://www.washingtonpost.com/wp-dyn/articles/A15785-2005Mar8.html

Wachovia's taxes triple in '04 due to no more “SILO”

http://www.ledger-enquirer.com/mld/observer/11047634.htm

Chief of Riggs Bank Resigns, Citing Its Pending Merger With PNC

http://www.nytimes.com/2005/03/08/business/08riggs.html

Tyco Witness Tells of Undisclosed Benefits

http://www.nytimes.com/2005/03/08/business/

08tyco.html?pagewanted=all

Justices, 7-2, Reject Secrecy at Tax Court

http://www.nytimes.com/2005/03/08/business/

08bizcourt.html?pagewanted=all

Snow: Bono may make short list for World Bank

http://www.usatoday.com/money/world/2005-03-06-bono-worldbank_x.htm

Institutional Investor's Inaugural Securitization News Awards

http://www.absnet.net/headlines/sn.awards.pdf

Wednesday night will be Dan Rather's last at the anchor desk.

http://www.nytimes.com/2005/03/08/arts/television/08rath.html?8hpib

Martha Stewart, back at work after five months in prison, says she is a changed woman

http://www.signonsandiego.com/news/nation/

20050307-1456-marthastewart.html

Extramarital affair topples Boeing CEO

http://www.usatoday.com/money/industries/manufacturing/

2005-03-07-boeing-stonecipher_x.htm

---------------------------------------------------------------

“Gimme that Wine”

California vintners harvest banner sales abroad

http://www.modbee.com/columnists/moran/story/10071534p-10898898c.html

Record Number Earn Master Sommelier Diploma; Eleven Wine Professionals Awarded Master Sommelier Title

http://home.businesswire.com/portal/site/google/index.jsp?ndmViewId=

news_view&newsId=20050303005601&newsLang=en

Sommelier training uncorks intimate education in the grape

http://www.eastvalleytribune.com/index.php?sty=37271

Napa winemaker extends family tradition

http://www.azcentral.com/arizonarepublic/food/articles/0302tarbell02.html

North Carolina Wine enthusiast broadens horizons

http://www.gotriad.com/article/articleview/14381/1/16/

-----------------------------------------------------------------

This Day in American History

1717 - On Fishers Island in Long Island Sound, 1200 sheep were discovered to have been buried under a snow drift for four weeks. When finally uncovered, one hundred sheep were still alive.

1726-Morris Lewis, signer of the Declaration of Independence, born at Westchester County, NY. Died Jan 22, 1798, at Morrisania Manor at NY. All of the Morris property and nearly all of his wealth had been destroyed in the revolution. Morris should have left Congress to ward off an impending British attack on New York which, by the end of June, had not occurred. Instead, Morris was on hand to sign the Declaration, even though he knew that a large British army had landed within a few miles of his estate, that their armed ships were lying within cannon shot of his homestead, and that his extensive possessions would probably be pillaged. "Damn the consequences, give me the pen," Morris is said to have shouted. Soon after, more than a thousand acres of woodland, all located on navigable water, were burned, his house was ransacked, his family driven away, his livestock captured, his domestics and tenants dispersed, and the entire property laid waste and ruined. For the next six years, he and his family suffered many privations, until the evacuation of New York City. Early in 1777, he relinquished his seat in congress to his half-brother, Gouverneur, on which occasion that body passed a resolution complimenting him and his colleagues "for their long and faithful services."

1731-William Williams, signer of the Declaration of Independence, born at Lebanon, CT. Died there Aug 2, 1811.

http://www.ushistory.org/declaration/signers/williams.htm

1834-previously, mayors had been chosen by a board of the Common Council but the first city major was elected in New York City when Cornelius Van Wyck Lawrence, a Democrat, defeated Gulian Crommelin Verplanack, a Whig, in the three-day election which ended April 10. There were 34,988 votes cast, of which 17,573 were for Lawrence, 17,393 for Verplanck, and 22 for others. Seven other municipal officers were also elected.

1856—Birthday of Mary Wright Plummer, librarian whose innovations included setting up the first art reference department and a children's library with child-sized furniture and easily reached shelves.

1856 -- Battle of Connell's Prairie, the last major Indian battle in Puget Sound. see 577 PATKANIM HAS A RATTLE WITH LESCHI'S BAND.

http://www.usgennet.org/usa/or/county/union1/1889vol1/

1889volumeIpage572-589.htm

1872-African American playwright, born at Glasgow, MO. Best known for prize-winning comedy The Church Fight , which was published in Crisis (a publication of the NAACP) in May 1926.

1872-the "Father of Canadian Rodeo," O. Raymond Knight was born at Payson, UT. His father, the Utah mining magnate Jesse Knight, founded the town of Raymond, Alberta, in 1901. In 1902 Raymond produced Canada's first rodeo, "Raymond Stampede." He also built rodeo's first grandstand and first chute in 1903. O. Raymond Knight died Feb 7, 1947.

1873-Alfred Paraf of New York City, who organized the Oleo-Margarine Manufacturing Company, obtained a patent on his process for purifying and separating fats. 1886, Congress imposed a tax regarding the manufacturer, importing and exporting of oleomargarine.” 1877 New York enacted “ an act for protection of dairymen and to prevent deception in sales of butter.”

1886- Alice Throckmorton McLean, president American Women's Voluntary Services in WWII with a working membership of more than 325,000 who did everything from selling bonds to teaching, to mechanical work to air raid defense management.Her mother was one of the founders of the day nursery school movement. (Studied the British, Finnish, and Swiss volunteer organizations and founded the AWVS in 1940 as a private organization.) They sold a billion dollars worth of War Bonds. They took photographs of men and women in the service for their families back home, made and reconditioned clothing for children and babies, and chauffeured almost 400 military cars.

1904-Hirsch Jacobs, thoroughbred trainer and owner born at New York, New York. Jacobs became a trainer in 1923 and was particularly adept at selecting horses in claiming races. He saddled 3,596 winners and earned $15,340,354. died at Miami, FL, Feb. 13,1970.

1909—Birthday of novelist John Fante.

http://www.canongate.net/people/pep.taf?_p=2154

1909 - The town of Brinkley AR was struck by a tornado which killed 49 persons and caused 600,000 dollars damage. The tornado, which was two- thirds of a mile in width, destroyed 860 buildings. Entire families were killed as houses were completely swept away by the tornado. Tornadoes killed 64 persons and injured 671 others in Dallas and Monroe counties during the Arkansas tornado outbreak.

1912-Sonja Henie, Olympic gold medal figure skater, born at Oslo, Norway. Henie competed in the 1924 Winter Olympics when she was just 11, but finished last in ladies' singles. She won gold medals at the Winter Games of 1928, 1932 and 1936. She became a professional skater and an actress ( Sun Valley Serenade ). Died Oct 13, 1969.

1913- 13th Amendment ratified declaring U.S. Senators to be elected by popular vote, not by the Legislature Amendment. Prior to this, members of the Senate were elected by each state's respective legislature. The advent and popularity of primary elections during the last decade of the 19th century and the early 20th century and a string of senatorial scandals, most notably a scandal involving William Lorimer, an Illinois political boss in 1909, forced the Senate to end its resistance to a constitutional amendment requiring direct popular election of senators.

1918 -a big spring snowstorm buried the Potomac Highlands of West Virginia with 34 inches of snow at Wardensville, 30 inches at Moorefield, and 29 inches at Romney.

1919 - A tornado swarm in northern Texas resulted in the deaths of 64 persons

1920--Singer Carmen McRae birthday http://www.ddg.com/LIS/InfoDesignF96/Ismael/jazz/1950/McRae.html

http://www.gallery41.com/JazzArtists/CarmenMcRae.htm

1921-guitarist Leroy Holmes born Woodbine,FL

1926 - The lightning-set oil depot fire near San Luis Obispo CA boiled over and engulfed 900 acres. Many tornado vortices resulted from the intense heat of the fire. One such tornado traveled 1000 yards, picked up a house and carried it 150 feet, killing the two occupants inside.

1926—Still going strong, Hugh Hefner's birthday, born Chicago, Illinois. He is 79 years old today. Goes to show you what a little Viagra can do for you, plus reading Playboy Magazine.

1933- Broadway lyricist Fred Ebb was born. He is best known for the musical "Cabaret," which opened in New York in November, 1966 and ran for 1,166 performances. The original cast included Joel Grey, Jill Haworth and Lotte Lenya. Grey reprised his role in the 1972 film version of "Cabaret," which also starred Liza Minelli. The film won a number of Oscars.

1935-Congress approved the Works Progress Administration (WPA). Created by President Franklin Roosevelt to relieve the economic hardship of the

Great Depression .

http://memory.loc.gov/ammem/today/apr08.html

1935 -- Thomas Wolfe's second novel, Of Time and the River, is published to great acclaim.

http://www.todayinliterature.com/stories.asp?Event_Date=3/8/1935

http://library.uncwil.edu/wolfe/wolfe.html

1939-the first Intercollegiate Rodeo was held at historic Godshall Ranch, Apple Valley, CA. The student cowboys and cowgirls, who hailed from California and Arizona colleges and universities, were assisted by world champion professional cowboys including Harry Carey, Dick Foran, Curley Fletcher, Tex Ritter and Errol Flynn from Hollywood. Collegiate rodeos had been held since 1919 at Texas A&M University. College cowboys and cowgirls organized a national association in Texas in 1949 named National Intercollegiate Rodeo Association, which continues today as the only national college rodeo organization.

1943 - Wendell Wilkie's "One World" was published for the first time. In less than two months, sales reached a million copies. In 1940, he lost the presidential race to Franklin D. Roosevelt by almost five million votes.

1946- James Augustus ("Catfish") Hunter, Baseball Hall of Fame pitcher, born at Hertford, NC. Died Sept 9, 1999, at Hertford.

1949-What television does today, radio did in 1949, drawing our full attention to, three-year-old Kathy Fiscus of San Marino, CA: while playing, she fell into an abandoned well pipe 14 inches wide and 120 feet deep. Rescue workers toiled for two days while national attention was focused on the tragedy. Her body was recovered Apr 10, 1949. An alarmed nation suddenly became attentive to other abandoned wells and similar hazards, and "Kathy Fiscus laws" were enacted in a number of places requiring new safety measures to prevent recurrence of such an accident.

1950-J.D. Salinger's story “For Esme—For Love and Squalor” appears in the New Yorker magazine.

http://www.levity.com/corduroy/salinger.htm

1952- President Harry S. Truman seized control of the nation's steel mills by presidential order in an attempt to prevent a shutdown by strikers. On Apr 29, a US District Court declared the seizure unconstitutional and workers immediately walked out. Production dropped from 300,000 tons a day to less than 20,000. After 53 days the strike ended on July 24, with steelworkers receiving a 16¢ hourly wage raise plus a 5.4¢ hourly increase in fringe benefits.

1954---Top Hits

Wanted - Perry Como

Cross Over the Bridge - Patti Page

A Girl, A Girl - Eddie Fisher

Slowly - Webb Pierce

1955-The first medal of honor to a helicopter pilot was conferred posthumously upon Lieutenant (j.g.) John Kelvin Koelsch of Hudson, NY. On July 3, 1951, Koelsch and Aviation Machinist Mate George M. Neal volunteered to rescue James V. Wilkins form North Korea. They took off in a helicopter without fighter escort. The helicopter was shot down and the three men were captured a few days later. Koelsch died of malnutrition and dysentery in a Korean prisoner-of-war camp on October 16, 1951.

1962---Top Hits

Johnny Angel - Shelley Fabares

Good Luck Charm - Elvis Presley

Slow Twistin' - Chubby Checker

She's Got You - Patsy Cline

1963 - Steve Brooks became only the fifth race jockey to ride 4,000 career winners.

1963 - the 35th Annual Academy Awards at Santa Monica's Civic Auditorium (Los Angeles). Frank Sinatra hosted. Seven Oscars including the #1 award for Best Picture went to "Lawrence of Arabia" (Sam Spiegel, producer) The epic production earned Oscars for David Lean (Best Director); Freddie Young (Best Cinematography/Color); John Box, John Stoll, & Dario Simoni (Best Art Direction/Set Decoration/Color); John Cox with Shepperton SSD (Best Sound); Anne V. Coates (Best Film Editing); Maurice Jarre (Best Music/Score - Substantially Original). Films of 1962 included Frank Sinatra's, "The Manchurian Candidate".) : "Mutiny on the Bounty", "Walk on the Wild Side", "The Longest Day", "The Music Man", "The Man Who Shot Liberty Valance", "Birdman of Alcatraz" and "Taras Bulba",. Those that won the top awards other than "Lawrence of Arabia" were "To Kill a Mockingbird" (Best Actor - Gregory Peck; Best Art Direction/Set Decoration/Black-and-White - Alexander Golitzen, Henry Bumstead, Oliver Emert; Best Writing/Screenplay Based on Material from Another Medium - Horton Foote); "The Miracle Worker" (Best Actress - Anne Bancroft, Best Supporting Actress - Patty Duke); "Sweet Bird of Youth" (Best Supporting Actor - Ed Begley); and "Days of Wine and Roses" [title song] (Best Music/Song: - Henry Mancini (music), Johnny Mercer lyrics).

http://www.infoplease.com/ipa/A0148906.html

1964 -- Malcolm X announces split with Nation of Islam.

“I had blind faith in him. My faith in Elijah Muhammad was more blind and more uncompromising than any faith that any man has ever had for another man. And so I didn't try and see him as he actually was.”

— Malcolm X, Audubon Speech, 15 Feb. 1965

1964 -- First invasion of Alcatraz, by Dakota Sioux who claim the island under the 1868 Sioux Treaty to remind America of more than 600 treaties which have been broken. They offer the government $6.54 for the land, based on the 49 cents per acre which was being currently proposed to be given as compensation for tribal lands stolen from Californian American Indians.

1966-in the last of a series of moves to abolish poll taxes, a three-judge federal court at Jackson, MS, outlawed Mississippi's $2 poll tax as a voting requirement for state and local elections.

1966- At the Astrodome, the Astros and Dodgers play baseball's first game on synthetic grass. Thanks to the Monsanto chemical company, who proposed using an experimental playing surface of nylon grass, the plan to play on an all-dirt field, necessitated by the need to paint the dome's glass panes to reduce the glare which prevented natural grass from growing, was alleviated by the use of 'Astro Turf'.

1966-The Jefferson Airplane opened at California Hall on Polk Street.

1968 - The Beatles went gold again, receiving a gold record for the single, "Lady Madonna".

1968- Bill Graham, owner of the Fillmore, San Francisco's legendary rock ballroom, opens the Fillmore east in an abandoned movie theater on Second Avenue and Sixth Street in New York City. The opening bill features Albert King and Time Buckley and Big Brother and the Holding Company.

1969 – The Montreal Expos, a national League expansion team, played their first regular season game, beating the New York Mets, 10-9, at NY's Shea Stadium. the Expos finished the year in sixth place in the NL East with a record of 52-110. They won their first division title in the strike-shortened 1994 season.

1970- Diana Ross opens an eleven date cabaret engagement in Framingham, Massachusetts, her first outing as a solo performer.

1970---Top Hits

Bridge Over Troubled Water - Simon & Garfunkel

Let It Be - The Beatles

Instant Karma (We All Shine On) - John Ono Lennon

Tennessee Bird Walk - Jack Blanchard & Misty Morgan

1971-New York City changed the “Sport of Kings” irrevocably by opening the nation's first off-track betting system. Horseplayers were now able to patronize OTB Parlors instead of going to the track to place their wagers.

1971 – “Chicago” became the first rock group to play Carnegie Hall in New York City. Through the 1970s and 1980s, Chicago scored big with these hits: "Make Me Smile", "25 or 6 to 4", "Saturday in the Park", "Old Days", "Baby, What a Big Surprise", "Hard to Say I'm Sorry" and many others.

1974- Henry (“Hammerin' Hank”) Aaron hit the 715th home run of his career, breaking the record set by Babe Ruth in ~1935. Playing for the Atlanta Braves, Aaron broke the record at Atlanta in a game against the Los Angeles Dodgers. He finished his career in 1976 with a total of 755 home runs. This record remains unbroken. At the time of his retirement, Aaron also held records for first in RBIs, second in at-bats and runs scored and third in base hits.

1974-Elton John earns another gold record. "Bennie and the Jets" has John smiling even more as it's a big hit on the R&B charts as well.

1975-Frank Robinson, professional baseball player, becomes the manager of the Cleveland Indians and the first Black manager of a major league team, 1975

http://cleveland.indians.mlb.com/NASApp/mlb/cle/history/

cle_history_timeline.jsp?period=4

http://www.baseballhalloffame.org/hofers_and_honorees/

hofer_bios/robinson_frank.htm

http://www.baseball-almanac.com/mgrtmci.shtml

1975-Frank Robinson made his debut as playing manager of the Cleveland Indians and the first black manager in the major leagues. Robinson hit a home run in his first at bat as the Indians' designed hitter, and Cleveland beat the New York Yankees 5-3.

1975-Minnie Riperton receives her only gold record for "Lovin' You," her recent Number One record.

1975 - "The Godfather: Part II" won half of the top six awards at the 47th Annual Academy Awards at the Dorothy Chandler Pavilion in Los Angeles. It won for Best Picture: (Francis Ford Coppola, Gray Frederickson, Fred Roos, producers); Best Director (Francis Ford Coppola); and Best Supporting Actor (Robert De Niro); plus Best Writing/Screenplay Adapted from Other Material (Francis Coppola, Mario Puzo); Best Art Direction/Set Decoration (Dean Tavoularis, Angelo P. Graham, George Nelson; and Best Music/Original Dramatic Score (Nino Rota, Carmine Coppola). The other three crowd- pleaser awards went to Best Actor Art Carney for his "Harry and Tonto" role; to Best Actress Ellen Burstyn for her part in "Alice Doesn't Live Here Anymore"; and to Ingrid Bergman as Best Supporting Actress in "Murder on the Orient Express". Hosts Sammy Davis Jr., Bob Hope, Shirley MacLaine, and Frank Sinatra livened up the party, even though murder, intrigue and disaster were in the run. The award for Best Music/Song went to Al Kasha & Joel Hirschhorn for "We May Never Love Like This Again" from the "Towering Inferno". "Inferno" also won for Best Cinematography (Fred J. Koenekamp, Joseph F. Biroc) and Best Film Editing (Harold F. Kress & Carl Kress); while Best Sound went to "Earthquake" (Ronald Pierce and Melvin M. Metcalfe, Sr.) and Robert Towne's "Chinatown" won for Best Writing/Original Screenplay.

http://www.infoplease.com/ipa/A0149298.html

1978---Top Hits

Night Fever - Bee Gees

Stayin' Alive - Bee Gees

Lay Down Sally - Eric Clapton

Ready for the Times to Get Better - Crystal Gayle

1986- Facing Nolan Ryan of the Astros, Giant rookie Will Clark homers in his first major league at-bat.

1986---Top Hits

Rock Me Amadeus - Falco

R.O.C.K. in the U.S.A. - John Cougar Mellencamp

Kiss - Prince & The Revolution

100% Chance of Rain - Gary Morris

1986 - It took 18 years of singing the U.S. national anthem, but on this day, at long last, baritone Robert Merrill of the Metropolitan Opera became the first person to both sing the anthem and throw out the first ball at Yankee Stadium for the Yanks home opener.

1987-for the first time in modern major league history, two 300-game winners pitched for the same t4eam in the same game. Phil Niekro and Steve Carlton combined their pitching talents to lead the Cleveland Indians to a 14-3 victory over the Toronto Blue Jays. Niekro started for the Indians and earned his 312th career victory. Carlton pitched four shutout innings of relief.

1987 - Thirty-two cities in the eastern U.S. reported new record high temperatures for the date, including Madison WI with a reading of 71 degrees. Afternoon highs of 68 degrees at Houghton Lake MI and 72 degrees at Flint MI smashed their previous records for the date by fourteen degrees.

1989- 26-year-old David Hirsch replaced 59-year-old Dick Clark on "American Bandstand." His debut also marked "Bandstand's" move to the USA cable network from national syndication. Clark had been the host of the program for 33 years, introducing teenagers to Stevie Wonder, The Jackson Five and Madonna, as well as to such dance crazes as the Twist and the Jerk. The program debuted on a Philadelphia TV station in 1952, and Clark took over in 1956, the year before "Bandstand" went on the ABC network.

1989 -two dozen cities in the southwest reported new record high temperatures for the date. Phoenix, Arizona hit 104 degrees which tied its record for the month of April set only the day before.

1990-While we celebrate birthdays, it is perhaps fitting to remember Ryan White today. This young man, born Dec 6, 1971, at Kokomo, IN, put the face of a child on AIDS and helped promote greater understanding of the disease. Ryan, a hemophiliac, contracted AIDS from a blood transfusion. Banned from the public school system in Central Indiana at the age of 10, he moved with his mother and sister to Cicero, IN, where he was accepted by students and faculty alike. Ryan once stated that he only wanted to be treated as a normal teenager, but that was not to be as media attention made him a celebrity. A few days after attending the Academy Awards in 1990, 18-year-old Ryan was hospitalized and on Palm Sunday lost his valiant fight at Indianapolis, IN. His funeral was attended by many celebrities who wanted to honor him.

1990 - Twenty-two cities reported record low temperatures for the date as readings dipped into the 20s and 30s across much of the eastern U.S. Freezing temperatures severely damaged peach and apple orchards in West Virginia, where prolonged mild weather since January had caused an early blooming of spring vegetation. State and Federal agencies estimated a 50 percent loss in production for peaches and "Delicious Red Apples"

1993- "Beavis and Butthead" premieres on MTV as a series. The two mutant characters had previously appeared on another MTV program, "Liquid Television."

1996 -the first of two late season heavy snowfalls in only three days over the northeast dumped 12 inches of snow at Slide Mountain, New York, 10.2 inches, at Ashburnham, Massachusetts, and 7 inches at Falmouth, Massachusetts. The 6.1 inches at Binghamton, New York brought its seasonal snowfall total to 131.8 inches -- its snowiest winter ever.

2000-Santana performs at the Pasadena Civic Auditorium with people who collaborated with him on his Supernatural album including Dave Matthews, Lauryn Hill and Everlast.

2003 In a frigid 35-degree home opener, with the fans chanting his name, Hideki Matsui hit his first major league home run, a grand slam into the right field bleachers. After be greeted with a warm reception in the pre-game ceremonies and a standing ovation after making a great defensive play, Godzilla receives a thunderous applause and curtain call from the sold-out Yankee Stadium crowd after his fifth inning bases-full poke against the Twins.

Stanley Cup Champions This Date

1943 Detroit Red Wings

----------------------------------------------------------------

Baseball Poem

In honor of “Hammerin' Hank's 714 home run, the days before baseball players started using steroids to improve their performances. Our regular series of baseball poems will be when the season official opens.

Hammerin' Hank

by D. Roger Martin ©

You did it, Henry.

You took The Babe's untouchable record

and stuffed it in your pocket.

Not bad for a gangling

black kid from Mobile.

The TV cameras were set to roll,

the reporters were poised

and the stage was set

with you and Al Downing

in the multi-million dollar spotlight.

Your teammate, Tom House,

caught the home run ball in the bullpen,

which was good economics.

That could have been

and expensive ball to buy back.

"A black Babe Ruth," they said you were.

Now it's your record

that stands casting its shadow-

a distant target

for future sharpshooters,

probably as yet, unborn.

And doesn't it make you wonder, Henry,

if things have really changed

since Jackie Robinson

courageously showed the world

there was another color of man

who could play this game.

Will any of us live long enough

to hear some wise scribe say,

"Here's a kid who

really has a chance to be

a white Henry Aaron."

|

www.leasingnews.org |